Should You Go For Child Plans as Education Cost Shoots Up?

With the help of a child insurance plan, a parent can secure his/her child’s future. He/she can pay for the child’s schooling, higher studies, etc.Read on to know how a child plan can help as education costs rise.

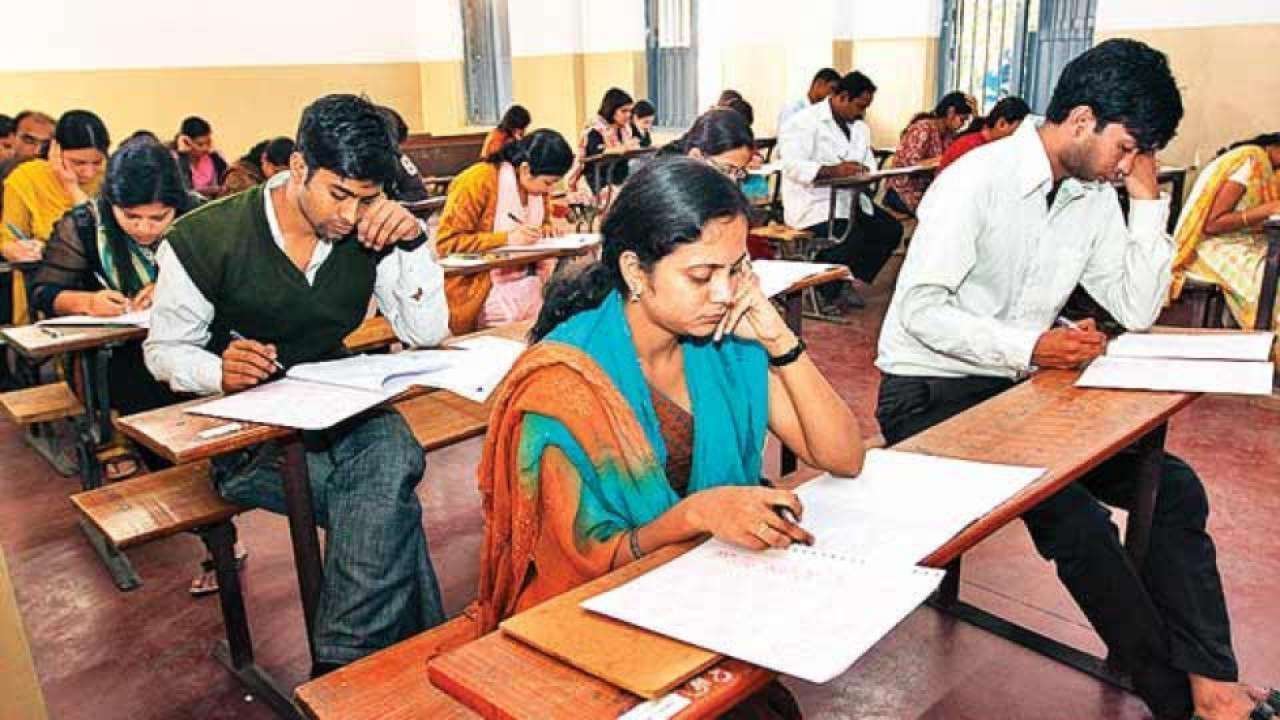

Education is critical in order to secure a child’s future. However, the cost of education keeps rising every year. Therefore, it can be difficult for a parent to meet the expenses. However, a person can purchase a child plan to pay for the expenses arising due to education.

A child insurance plan provides the benefits of insurance and investment. It can provide financial assistance in case of an unfortunate event. Furthermore, it can help in building a substantial corpus. The accumulated corpus can be used to fund a child’s education.

Here are the reasons why you should invest in a child insurance plan as education cost increases-

It can help Pay for Education Expenses

Educating children is the one of the most important concerns for every parent. However, it can be extremely expensive to provide education. A child insurance plan can be a good option to build a corpus for funding education expenses.

Furthermore, staying invested for a long time can be beneficial. It can give parents time to accumulate a significant corpus.

It can Help in case of an Unfortunate Situation

Apart from helping build a corpus, a child insurance plan also provides insurance benefits. If the policyholder passes away during the tenure, then the insurer can provide the sum assured to the beneficiary.

It Provides Maturity Benefit

The cost of education will keep on rising. Therefore, it is of utmost importance to invest in a child insurance plan in order to ensure the child receives financial assistance to achieve his/her educational goals. Also, the premium paid is eligible for tax deduction under section 80C.

It Allows Partial Withdrawals

In case a child wants to take up a special course, a parent can pay for such a course with the help of a child insurance plan. There are a few child insurance plans that offer periodic payouts. Such partial withdrawals can help parents to fund the course’s fees. Furthermore, by availing partial withdrawals, a person can lower his/her tax liability.

It Can Ensure there is no Loss of Capital

There are various investment instruments, and a person needs to choose options based on his/her risk appetite and tenure. Furthermore, to avoid capital loss, a person can opt for a systematic transfer plan and fund selection to plan investments according to the expected returns. With such a plan, an investor can switch to a different fund to deal with the fluctuating market.

Consider Purchasing Child Insurance for your Child’s Future

A child insurance plan can be beneficial in order to secure your child’s future. It can help you build a significant financial corpus that might be required to fund your kid’s education. Keep the aforementioned points in mind while selecting a child insurance plan.